Stanford GSB Sloan Study Notes, Week 7 (27), Winter quarter

After the public holiday last Monday (which I realized could not have been more eclectic between sick kid babysitting, running, building a unit economics model for a startup business plan assignment and babysteps in hacking social graph analysis in Mathematica) there was no breathing room throughout the rest of the week.

Eric Schmidt taught his legendary IPO class, we took a bunch of convertible note based seed financing setups apart and put them back together, the original mad-scientist-turned-CEO Art Levinson shared his thoughts on scaling innovation, we discussed how different can be the approaches to seemingly similar private equity investments, I finally made it over for a long-overdue visit to Stanford Technology Ventures Program and there was a fun reunion with ever-joyful Meg Whitman whom I hadn’t seen since the good old pre-politics and pre-HP days of her more regularly hanging out with us at Skype, in Tallinn and elsewhere.

When I was walking towards the study rooms on late Friday afternoon to get at least a bit of the two different finance group projects due Monday on the way, ahead of the expectedly busy Estonian Independence Day weekend, I got rerouted in a room where Craig Barrett, long-time Intel chairman & CEO was having a candid small class discussion about navigating global business structures despite of government interventions. Only in Stanford. Good news: what he figures competitive nations are supposed to do is pretty much aligned with where the 95-year-old birthday state of Estonia is heading.

And after all this, the most unexpected meeting of the week? Perry, the original Shrek donkey. (He is on YouTube too)

Covered in this issue:

- How and why Google ended up running an unusual IPO process

- Changing landscape of seed & angel investing + rare data on performance

- Scaling innovation from startups to large public companies

- Inner workings and different flavours of Private Equity partnerships

- How defaulting and going bankrupt is different between US and various EU markets

- Practical guide to managing through international trade barriers

- Guests: Meg Whitman (eBay/HP), Art Levinson (Genentech/Google/Apple), Craig Barrett (Intel), Google Ventures, Snapchat, Private equity partners from General Atlantic, TA Associates, Francisco Partners

STRAMGT 354: Entrepreneurship & Venture Capital (Wendell)

Unfortunately can not publish my notes from (fantastic) class discussions – there is a no-blogging policy to protect honest conversations and especially the guests.

Case: Google IPO (taught by Eric Schmidt)

Readings:

Google IPO Prospectus (Form S-1)

How I Did It: Google’s CEO on the Enduring Lessons of a Quirky IPO (HBR)

- Went for the dutch auction model to reduce the first day “pop” of valuation that the company should fairly claim, and democratise the distribution of shares to board base of consumer investors, not just insitutions. This made Wall Street generally unhappy and hostile. And the pop still happened – IPO priced at $84 opened at $100 and newer got lower (someone still made the quick $15 first day profit).

- A surprise publishing of an interview given back in April in September Playboy almost derailed the IPO – compromise with SEC was to include the interview fully in S1 for all investors (and thankfully, there had been no pictures)

- SEC is supposed to qualify the accuracy of all “qualitative and quantitative claims” made in S1 – they pushed back hard on even including the founders letter: how do you evaluate the promise of future values the organisation will be run by? Founders insisted.

- Quiet period before IPO is very painful: media, analysts, competitors can attack you however they want and you can not respond in any way. (Remember this from Skype S1 times too – as one side effect, it is not just your future investors, but your own employees who are reading all the crap in public channels and feel helpless)

- Day after IPO, announced the IPO done in management team and never discussed it there again. Get back to work.

- Dual-class stock (founders have 10:1 voting rights over new investors) is not common in tech, but originated and has been used for years in media (NYT, Washington Post) to protect editorial freedom and avoid change of control with money

Reading: As Facebook’s Stock Struggles, Fingers Start Pointing (NYT DealBook)

Case: eBay

Guest: Meg Whitman (ex-CEO eBay; CEO HP)

- First business plan for eBay (as AuctionWeb) was written by 4 students as a project for this very class!

Topic: Recent Trends in Pre-Series A Financing

Reading: The Changing Face of Angel Investing (Sahlman)

- Ram Shiram (Sherpalo Ventures; ex Netscape/Amazon/Google), on angel dilution: “I look at the number of rounds as your grade. If you take just an A round an get to success, you get an A, if you take a B round, you get a B. If you get all the way to an F round, you’ve failed.”

- Mike Maples (Floodgate):

- In tech, about 10,000 companies funded by angels a year, 1,500 by VCs. Out of that, 80 don’t suck – will exit >$50M. 20 of those will be worth >$100M. 10-15 >$500M. And the last 10, worth >$750 are the Thunder Lizards.

- The biggest an angel fund should get is the amount that you rationally think you could make in profit from the best single exit in the fund. Looking at probabilities of >$10B exits, and even $750M exits, if you raise a fund larger than $100M you will immediately become ownership percentage driven – you just can not afford to only take 10% positions in early stage, after dilution. With $500M fund you can’t make the numbers work taking <30% positions in companies. Your thinking changes to “will we get enough of this company?” from where you should be: “are we getting into the best company of the year at all?”

- Founder Collective – 2 managing partners, 6 Founder partners.

- Not reserving capital for follow-on rounds and remaining solely a seed investor aligns the incentives with entrepreneurs best. In “leaning in to your winners” strategy, you not participating in next rounds (and small funds always can’t) sends a fatal signal to market, you’r interest is to push the follow-on rounds’ price down, etc.

- CommonAngels – 75 people group in Boston

- Two types of angel groups: member-lead and manager-lead. We believe latter is better – someone has full focus and their career on the line to improve process and deliver returns. Also, try running a continuous fund for 10 years only with volunteers.

- With a $10M fund you can return the value with a single hit, and everything else is gravy. This gives you a lot of flexibility.

- Convertible notes with modest discounts can be a dis-incentive for the angels. Why help create (too much) early value, if that makes your investment convert into stock with higher value? Doesn’t matter in tiniest scenarios ($25-50k in a $250k round), but can become a nuisance with $1.5M seed round – at those numbers you also start missing the consensus-driving preferred equity rights notes usually dismiss.

- Pacific Lake Partners

- Search funds are for non-visionary entrepreneurs.

- No entrepreneur who doesn’t want to report to someone would take money from a single investor, if they can take it from 10.

Readings:

- Convertible Notes in Angel Financing

- Business Incubators (Wikipedia)

- Eight Reasons Startup Incubators Are Better Than Business School (Forbes)

- Startup Professionals Musings (Martin Zwilling’s blog)

- Scott Walker’s trilogy on TechCrunch on convertible notes (including security ties law and accredited investor status discussions)

Guests: Bill Maris, Adam Ghobarah (Google Ventures), Evan Spiegel (Founder & CEO, Snapchat)

Reading: A Growing App Lets You See It, Then You Don’t

View From The Top Speaker series

Guest: Art Levinson (Chairman of Genentech and Apple)

- “In God we trust, everyone else bring data”

- Booz & Co, Global Innovation 1000 study

- top R&D spenders; 1-2.5% of revenues (once you get out of health)

- R&D to sales data -> no correlation!

- Genentech hiring top scientists, let them do whatever they want – pending a review every 1-2 years. Publication is not just encouraged, but part of the promotion path, as a result 115 papers/year (VS Glaxo’s 50 with 10X company size!)

- Citations per paper (clinical medicine)

- MIT 58.9

- Genentech 44.9

- Harvard 43.6

- Stanford 39.1

- 500 patents (2006-2010), next best University of California with 72

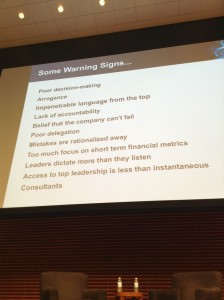

- Arrogance kills companies

- You can ever shape the Street with leadership: when you go as a CEO and tell them that for long-term investment you’re giving in in short term results for a while, ask only those who are OK with that remain as investors. Yes, 5% might sell, but 95% remain.

- Empirically, can’t find benchmarks for high company growth beyond 12 years in a row…

- I’ve been very focused on people I don’t like: why are they such jerks? How can I not become like THAT?

- Coming from scientific/academic background you’re not polite about things you think are wrong. Growing to CEO you have to become more polite, but can’t get to a point where you’re dancing around truth. White-glove like approach means messages get lost. Language is important.

- Can’t even read the Steve Jobs biography yet, too emotional. Emailing Steve at 12:30am he calls back in 120 seconds. When I had to choose between Google and Apple boards (for emerging business conflicts), there was no question – Steve was already sick and asked me not to walk away.

- Being in public eye is like the Lord of the Rings: tempted to put (the fame) on, but it will change you. Many good people have gone that way and can never return. I’ve chosen to keep a lower profile.

- Tradition of Ho Ho’s at Genentech (CNN article from 2006)

- Apple board sees prototypes 6-18 months ahead, non working things and longer-term discussions longer.

- “These were scientists, not particularly sophisticated people!” (on employee stock options)

- “Conventional wisdom sucks very often” and Apple, Google get it

- It is fine to change your goals, but never your values as an organisation

- US is basically subsidising the rest of the world’s pharma R&D… but as the internal healthcare spending has gone to 18% of GDP, this is not sustainable

Investment Club

Guest: Jeff Chambers, TA Associates

- Buyout fundraising peaked at 2007 at $434B, down to $13B in 2009! Back at $98B this year, but because of the 10 year horizon of the funds, there is a significant lag of effect (“alligator passing through the snake”)

- Since 2004, no single half year period where the new investments volume didn’t exceed the total exits volume. # companies in portfolios 2200->6400 since 2004.

- PitchBook – PE & VC database

- PE investments between VC, distressed debt, real estate, LBO, etc – no single strategy is dominant. Performance varies hugely between vintage years (VC first with +30% in ’97, single digits & in the bottom since)

- University endowments are looking at PE to get them 200-300bps above public markets.

- 2012 was the first year where there were more secondary sales between PE firms than PE firms selling to strategic buyers. Looking from LPs point of view this can be painful: if one fund sells to another, someone takes 20% profit out, but the LP still owns the same company!

- When you want to invest in fast growing, cash generating companies – the issue is that they don’t come calling for PE money. You have to go out and call 8000-9000 companies a year to make 10 investments. One associate makes ~1200 calls over their 3 year tenure, maybe a few lead to a deal – and this number doesn’t include pre-screening they do that doesn’t even lead to a call.

- Only 2-3 boards per partner – a lot of time to spend with them.

- Buying minority interest in fast growth most of the money goes to the founders, not company balance sheet. They don’t need it – and wouldn’t sell without personal partial cash out.

- Everybody seems to have a similar share of failures (2/10), what differentiates the best is the number of home runs (not just averages) among the rest.

- When large buyout funds even go into a minority investment, the contracts are usually very deeply structured and contain trip-wires that get them to decision making if things go wrong. The key question in the end of the day is: can you change the CEO if needed?

- You can buy preferred stock in India… but it has not been tested yet in courts if you really do come ahead of other investors in liquidation.

- When PE is competing with strategic investors too early, and wins on price – the question rises who can they really sell this thing later?

- Even if you are the most active investor, a monthly board meeting is more of a management meeting, too operational. Needs a differently structured PE firm, more operators, larger target companies (who can afford all the consultants), etc.

- If the pie stops growing, partnerships fall apart. Younger partners need a slice and in a stagnant pie it can only come on the expense of older partners.

- PE entry opportunities often derive from personal situations – diverging interests of partners, divorces, whatnot. In those situations the seller is not necessarily hunting for the highest price they can get.

- Pretty much every company selling today is represented by an investment banker. A good banker who knows the PE community is worth her fee. Yet, there is a risk of overselling – when we know you’ve sent the offer to 200 bidders, we don’t want to take the winners curse.

- What you say on the phone as a seller will be written down and remembered. You promised $14M and make $9M in two years… we will remember.

FIN587: Private Equity (Parker)

- General partners have unlimited legal liability… yet sometimes the GPs can be legal entities, which sort of defies that purpose.

- Pension funds are a huge source of capital for PE, but on macro level, decreasing in inflow as a separate asset class (as employees can invest in other instruments for retirement)

- 10-15% of total PE pie are high net worth individuals

- Issue for LPs: measuring the GP share of profits is not straightforward/standardised in the industry: 20% per deal or across portfolio? When, any payouts before actual exits? Before or after hurdle rate?

- [compensation] “scheme” has a much shadier connotation in US, than in British English (can cause awkward situations with London bankers/executives)

- A way to negotiate a fee without negotiating a fee: when a large LP gets an opportunity to co-invest. E.g you have $50M in fund (under normal fees), but could have $100M actually in play in target companies. Effectively cuts half the fees.

Guest: Bill Ford (CEO of General Atlantic)

- Ford is Parker’s GBS student, sit together on the First Republic Bank’s board

- GA investments: 69 total (12 new in 2012). ETrade, Box, Tory Burch, NYSE, Computershare, Mercado Libre… ETrade had already $20M revenue when was almost fully founder owned (no VC) – got a quarter of the company for $25M.

- Build-up investment: purchasing a series of companies in single space (‘medical labs”) and consolidating them into one, more effective company

- Occasionally public companies prefer to raise PE money through structured deals: for ex issuing preferred shares without public offering.

- Across the portfolio average 25% annual revenue growth & EBITDA margin

- Most managing partners in firm have 90%+ of their net worth invested in the funds! 10% of the total capital, aligns fully with LPs.

- All international investment managers are nationals, not US teams shipped around the globe

- There is a high correlation between great boards and company success

- If there is no time to do proper due diligence (demand to close in 2 weeks, not 2 months), we just have to pass

- 2/3 of our returns come from company and market growth, only a small portion from financial leverage

- Even if you have to change management at times, or the management teams are incomplete, you still start off by trying to find a CEO/entrepreneur who is backable. Out of 50 investments, 7-10 have had a CEO change in first 24 moths. Sometimes also CEO-initiated (“I am not the right guy to take this to the next level, but I’ll help”)

- Funnel, covered with 200 people: 1000+ investable opportunities (not random leads) -> 500 diligence -> 75 to investment committee -> final diligence -> 12 investments

- When screening media/blogs/publications for deal sourcing, step back and re-evaluate the list 2-3 months and check if it is really yielding leads (or is just entertainment)

- We are not aiming for 20X anywhere. At our ROC, to deliver consistent 2-2.5X to LPs you have to very carefully avoid losses.

- Very bullish on Mexico, especially with recent political changes and reforms, NAFTA, part of US supply chain, growing consumer activity. On the other hand Vietnam is exciting, 100M people, feels like China 15-20 years ago – but not quite PE investable environment yet.

- When a company goes public, our duties shift dramatically – the responsibilities are not to GA, but to all shareholders. Changes our view on board seats and how we want to be compensated.

- Cash flow wise first 4-5 years calls for capital in about equal splits (20-25% a year) and then the exits start bringing cash distributions back already in similar pace. So a $100M commitment doesn’t really mean that $100M leaves your account for 10 year duration of the fund.

- Stanford Endowment:

- Allocation: 22% public equity, 25% absolute return, 24% private equity

- 10 year annual performance 10.7%. Public equity 10.6%, Private Equity 14.4% (VC: 9%, Growth: 15%, Buyout: 9%), Natural Resources 21.1%

- Pays out 5% a year to University operating budget (amounts to about 25% of it)

- Timber (of natural resources) the lowest at 2%, cash returns even negative

- Venture portfolio heavily in US, Buyouts mostly US (Some in Europe), Growth heavily non-US

- PE funds have a lot of optionality, very vague terms: we will call the capital you have committed to us… at some unknown point(s) during next 5-7 years. When there are major macro events, can totally blow up the cash flow plans you might have built as an LP.

- PE and public market performance comparison on mechanical basis very tough. Because of the longer reporting cycles (quarterly vs daily), PE can seem like very low volatility and as it has higher performance, your analysis can easily show you should prefer it to publics any day. Not true.

- Fun of university endowment, you can take your long past investments data to the Best Mathematician in US under 40 in your Statistics department and ask him what he can make of it. De-smoothing is imperfect, but much better than not having it.

- Mean variance models assume normal distributions. So you build normal models, but then throw normality out and run stress cases with high correlation, fat tail of returns…

Guest: Dipanjan “DJ” Deb, (Founding partner, Fransisco Partners)

- GSB ’96

- FP is Mid-market (vs SilverLake, KKR, Blackstone, TPG in “mega buyout”), technology focused. Founded in ’99, 33 people, $7B across 3 funds, 59 companies (73 follow-ons)

- Partnering with Sequoia (whose VC funded companies are 20% of Nasdaq value)

- Low leverage (avg <2X, versus buyout traditional 5-6X). Because in the nature of tech business, the less leverage you have the more opportunity you have to reinvent yourself when markets drastically change – and they will.

- IT spending has outperformed GDP growth 2:1 for 40 years.

- Macro dominates Micro. You can screw up micro (P&L, product line, …) and still make money if the macro is right (right management, right market…). Not vice versa.

- Buying either value or market growth

- Novell: grossly mismanaged, $2B market cap, $1B cash. Sold a patent portfolio to Microsoft, Apple, etc for $0.5B – so basically got the entire company for $500M to turn around

- Cash on cash is a wonderful ratio for evaluating tech companies.

- You can benchmark a single PE investment in semiconductor company against the public semiconductor index for the same period. Is the Price / EBITDA multiple the same or better? If just the same (even if 5X growth on both), it was actually a bad investment, you could have gotten the same performance from liquid public investment.

- We’re drawn to messes. Messes create value.

- Complexity arbitrage – buy confusion at discount, sell clarity at premium.

- Product line profitability analysis often creates epiphanies. Interesting that so many of tech CEOs are engineers and scientists, but forget doing math on their own company – like expecting equally 25% returns across all different product lines. Math always prevails.

- Most taking private deals fail because the stocks run (someone always tells their friend when they shouldn’t and trading starts) and the price PE guys need for turnaround doesn’t make sense any more.

- In mid-size companies, if you’re not talking to CEO, you’re not talking to the right person (as an investor). CFOs don’t make the decisions really yet, as they do in large companies.

- The great people in PE are the ones who can do time management well. You’re working on 20 deals and you need to recognise when you have a real fish on the hook, drop everything else and focus fully on closing the one thing.

- The tech industry has an overarching belief that everyone’s business models eventually go away. Well functioning companies are much less valued (multiples-wise) than anything with the promise of disruption. In many cases it could be true, but we’re looking at cases where it is not true – the business model is actually solid and undervalued.

- On cyclicality: a LP who invested $18B in PE in 2008 and $900M in 2009. If they had done the opposite, could have gotten 7-8% better returns.

- Investment proposal: 40-90 pages of Powerpoint. Sent out on Friday, committee members respond with questions on Saturday and investment team has Sunday to think about answers for Monday. This coming monday are 5 items on agenda – I know my Saturday is shut. Porter’s Five Forces & SWOT.

- PE firm that routinely gets 2X on money has business perpetuity. Makes you like 1.5..3X proposals more than 0.5..5X ones. Consistency is good when working with your LPs, even though they can actually get diversification elsewhere.

- We never model exits based changes in multiples compared to when we invest. Maybe makes us more conservative than we should – and if we look at deals we regret we missed they are often the ones where not just volume grew, but the multiples improved fundamentally in the market.

- Irony of LP relations: they say they don’t want partner turnover. Yet, 80/20 applies and you still should turn over worse performers over time to run an excellent company.

FINANCE 229: Sloan: Core Finance (Strebulaev)

Distress, Default & Bankruptcy

- Experimental economics (now morphed into behavioural economics) games have been played for about 40 years – ultimatum game, fairness game, etc – but have started to receive really practical application attention quite recently. For example, you can use the fairness theory to explain why anchoring just this side of crazy works in negotiations, but anchors outside of perceived fairness are psychologically disregarded. (Unpublished Stanford experiment in Palo Alto real estate)

- Interest Coverage Ratio: to determine firm’s short term liquidity (and distress), you need flow (not stock) parameters on both sides of the ratio. Instead of debt/equity (total stock of both), look at EBIT/Interest due this year.

- When issuing debt, think of what type (public/private, secured/unsecured, senior/junior, term, line of credit…) before how much.

- A change in regulation in South America showed the effect of private vs public debt: when the banks started changing information on credit ratings and defaults of their clients, the average number of banks a medium sized business was using dropped 16 -> 5-6 in 2 years.

- Liquidity differences of private & public debt have virtually diminished.

- Private debt covenants are usually much tighter, on early signals of problems and for orderly renegotiation (rarely for full withdrawal & default). Public debt covenants, if violated, are a good indicator of distress.

- Trade credit is usually the most expensive. Even if you think it is for free (just pay your small and dependent suppliers months later), you could probably renegotiate your costs heavily if you went back to them and asked what the input prices were if you paid in 30 days? Or 10 days?

- GE finances itself with very short term, weekly commercial papers (cheapest public debt). The week Lehman Bros collapsed on Monday (defaulting all its commercial papers), US Treasury intervened on Thursday afternoon very harshly and became the only buyer in the frozen commercial paper market. Why? Because on Friday noon, GE was due to issue $30B of their weekly debt again, and the economy would not have survived a AAA-rated company defaulting. GE is run so lean that they don’t sit on that much cash.

- Economic distress is an inability to produce cash flows at all (“controlling 94% of the market no-one is interested in”). Financial distress is a short-term mismatch of cash flows (“can’t pay the weekly bills”).

- In 19th century the term for default was “embarrassment” (from card games -> business; “the Directors of X Railroad embarrassed themselves last Thursday”)

- Out of companies in financial distress in US, about 51% go into financial restructuring, and in turn about half do it through bankruptcy: 83% Chapter 11 bankruptcies emerge in restructured form, 7% merge and only 10% get liquidated.

- In Europe, the recovery rates from average bankruptcy range from 29% (Poland) to 86% (Denmark, Belgium). Takes avg 3 years in Poland, Switzerland to <1 year in Belgium.

- UK has full creditor protection, France has virtually none – everybody (government, employees, process costs) come before debt holders.

- The management’s fiduciary duties change in bankruptcy, from equity holders to debt holders. In scenario where management owns a lot of equity personally, this can be hard to achieve in reality – which could lead to debtors to ask the judge to remove the management.

- “Bankruptcy shopping” in Europe – a multinational choosing where the regulations are more favourable for their particular bankruptcy case. No real harmonisation yet between large markets (UK, FR, DE)

- Supra-priority financing: the ability for a company under Chapter 11 to borrow money to keep operating. These creditors receive precedence over the one existing ones.

- Empirically, the stock of an acquisition target goes up less on announcement if the offer is in stock, rather than cash.

- Convertible debt (in academic literature called sweetened debt) is used in medium sized corporations too, not just early stage risky investments. For ex: when dealing with investors whose tax treatment values that structure, as mezzanine before IPO, etc. Especially useful for companies with high beta: it is basically debt + option value, and option value is higher with high beta.

- Debt as a governance mechanism: to prevent managers using cash inefficiently. Often leverage is thought as a tool to get better tax treatment, but often up to 80% of value comes from added discipline and efficiency.

- BOOK: Barbarians at the Gate: The Fall of RJR Nabisco – The leveraged buyout of the RJR Nabisco Corporation for $25 billion is a landmark in American business history, a story of avarice on an epic scale.

- When evaluating the risks for investors, consider when are bondholders vs equity investors going to lose? In case of debt: cash flow interruptions, distress & default.

- As of now, only 4 non-financial US companies have AAA credit rating (was 25 AAA 15 years ago).

FINANCE 373: Entrepreneurial Finance (Korteweg)

Case: Airbnb (and specifically their time at Y-Combinator)

Incubators & Accelerators

- YC doesn’t provide shared office space, to leave startups the romantic memory of their first scrappy office. Weekly dinners instead.

- Per surveys, 90%+ of incubators offer coaching, IT infra, PR, recruiting. Slightly less legal support, accounting, office space and funding. Less common incubator services: 64% offer pooled buying (media), 26% organised networking (outside mentors and partners).

- To understand the role of incubators VS VC-s, just look at the subtle differences between questions YC asks vs what you need to include in VC pitch

- Case scenario with Seqoia pushing Airbnb to give an answer on their (relatively low) term sheet in 24h.. before demo day.

Case: Smartix

Guest: Vivek Khuller (Founder, Smartix)

- Bringing a technical guy into a business group of co-founders (equity-wise) is tricky, because these sides would put different value on the criteria (and relative importance/weight of) on which to base the equity splits

- Wouldn’t take a massive first client (Madison Square Garden) again as the first client, too uneven distribution of power and resources. Makes sense to go more step-by-step (university -> smaller sport venues -> MSG for tickets) and raise VC money on the smaller projects too, keeping the biggest ones as your upside even if you believe they are in reach.

- No-one gave us the advice to take the middle step. Everyone steered us to “raise as much money as you can”, “money is cheap”, etc.

- Jack Welsch’ 4-E for leadership also apply for hiring co-founders

- “If it is not worth someone else’s money, it is not worth my time” – on becoming an EIR to develop an idea into a company. Of course, you should stay in this phase for 2-3 months, then maybe 6 month phase, rather than a year from start.

- When you’re an EIR, there is a gun to your head. Everything is light speed.

- When you have people on your team who are not full-time (yet), take them along to a VC pitch, so their commitment to join after financing comes from them, not you.

- The responsibility that comes with owning the largest chunk of equity is immense. Imagine that you own 1% less than the largest, how much of a relief it is. As you get older you actually get to a phase where you want others to own more than you – so you can work less, stay strategic and close deals, leaving someone else to be the CEO with 60% stake.

FINANCE 385: Angel & VC Investments (Strebulaev)

- A lot of angel decision making happens via “elimination by aspects” – a shortcut decision making heuristic. You see something fishy you skip without a deep dive (the “fatal flaw” search). The trade-off is speed vs accuracy.

- Post-investment regrets: Angels and VS diametrically opposite!

- Angels: More due diligence (35%), More contract control (12%), Invest more (7%), Recruit and replace more (5%), Monitor more (3%)

- VCs: Recruit & replace (15%), Invest more (12%), Monitor more (10%), More contract control (8%), More due diligence (5%!)

Article: The Consequences of Entrepreneurial Finance: Evidence from Angel Financings (Kerr, Lerner, Schoar 2011; PDF)

- First proper academic study on if angel investments matter: Tech Coast Angels & CommonAngels data, compare funded & rejected deals.

- Funded deals have superior outcomes (improved survival, more likely exit)

Article: Returns to Angel Investors in Groups (Wiltbank and Boeker 2007)

- 2007 data on North America, 539 angels, 86 angel groups, 1137 exits.

- Average return 2.6X in 3.5 years (27% IRR)

- 52% deals returned less than put in, 7% returned 10X+

The International Economy

Guest: Craig Barrett (retired CEO/Chairman, Intel)

- Typical international corporation:

- 70-80’s: 60% US, 30% EU, 10% JP, everything else a rounding error

- 2013: 30% US, 30% EU, 30% Asia+, 10% JP

- Non-tariff trade barriers – the game really hasn’t changed in last 30 years:

- Japanese skis: “our snow is different, skis from elsewhere don’t work”

- Local content requirement: Intel’s plant in Ireland because EU limits on selling microprocessors that don’t contain “European content”

- India following today what Europe did in 80s (local content in electronics procured by Government going from 20->100% in 5 years)

- National standards

- When intersecting with information security: foreign players don’t have IP for crypto required by local government. Leads to irrational argument of “if it is made here I know it is safe,” rather than “how it is made”.

- Subsidies (agriculture)

- IP rip-offs (and closing an eye on them)

- A legalising way: a government forcing Compulsory Licencing of production of a foreign invention locally (1st case: in pharma in India in May 2012 – a lot of debate since)

- Rules and regulations: GMO ban in Europe

- Boycotts: how many Israeli products sell in Arabic markets?

- Currency

- When attracting foreign investments, tax breaks are the carrot (a US company can get better than their ~25% before loopholes almost anywhere in the world), direct capital grants to overcome any remaining fears.

- Export controls are very political and can be irrational: for example an average Ford car that can be exported has exactly the same chip in its engine controller that the one that is not allowed to be exported separately (to avoid building missile controllers).

- Intel can put factories in China, but they are limited to stay a few generations behind in tech than the ones back home.

- Likewise, Intel shouldn’t be worried about compulsory licensing – Moore’s Law moves faster than any government, let them try to copy you. Anywhere where your product is stationary, has constant production value for 5-10 years – there is time to copy.

- For software players facing piracy issues in developing markets, really the only way is to go and help grow local indigenous software industry to grow local respect for intellectual property.

- All BRIC countries are pretty much there with following the protectionist playbook. Just go down the list, Indonesia, Mexico, Philippines, etc will be next – and you pretty much know how.

- Monopolies are bad only when you abuse them. Every country has a patent system (= grants monopoly for an idea), but the tracking and intervention to abuse is different. In US, “bad” = hurts the consumer, in EU, bad = hurts competition. This is the fundamental difference between two largest tech markets in the world.

- That said, it is always more fun to work at the company who becomes a target of other companies complaints though.

- Ways how labor laws can get insane: french 35-hour work week applied to e-mail servers in the country (keeping e-mail moving 24/7 forces people to work!), option laws in Denmark have people vest even after leaving (it was “an implied promise” by employer)

- Top 5 International trade questions today:

- European finances: currently EU is schizophrenic – do we want to be Greece or Ireland?

- US Finances: still kicking the can down the road

- Believe there are two big trade agreements coming around – but is is it going to be Transatlantic or Transpacific first & foremost?

- Broad-based recognition by governments of what takes to be successful/competitive: education, investment in ideas (R&D), right environment for smart people/entrepreneurship (tax, IP, rule of law, cultural tolerance of risk & failure).

- Market shares are won and lost during periods of transition. This is here for countries today: 3 billion new capitalists, fundamental restructuring. It is always better to move before the market makes you move.

- Saudi Arabia – royalty wrote a personal check of $10B for endowment to get a new Science & Tech school going.

—-

For more posts on the Stanford GSB Sloan life – see the table of contents here.